Kentucky homeowners must know how to protect themselves from the natural disasters which can strike this state. Insurers are often asked to cover flooding, mudslides (winter storms), sinkholes and mudslides. Other types of claims, such as those for earthquakes and twisters, can also be covered.

Average Homeowners Insurance Cost in Ky

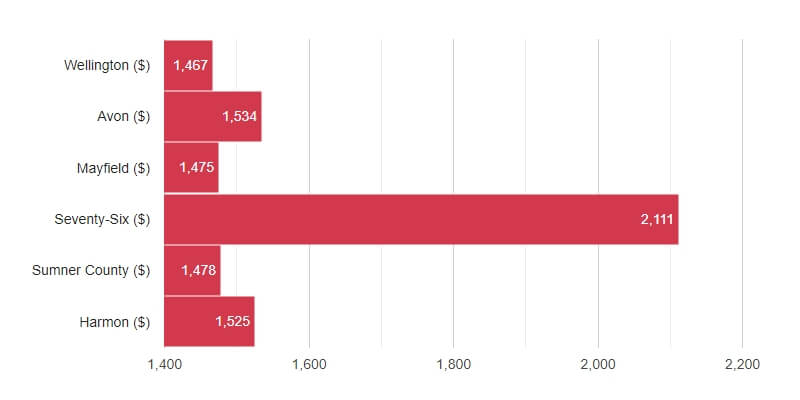

Kentucky homeowners insurance is quite affordable compared to the cost in other states. It is important to note that the cost of your premium will vary depending on a number of factors. The age of your house, for example, may affect your premiums. You can also find out what coverages are included in your policy, which will help you decide what level of protection you need.

Online quotes are the most accurate way to estimate your home insurance costs. Compare quotes and choose the right insurer for you.

Allstate: Best Overall

Allstate has been ranked as one of Kentucky's most popular providers of home insurance. It has low rates, good customer service ratings and offers a variety of extras to customize your insurance policy. It's a great option for those looking to save on insurance and still get the most coverage.

USAA - Best value for military customers

J.D. Customer Satisfaction Ratings for Veterans and Active Duty Service Members. The company has an average low rate of customer satisfaction, and is rated highly by J.D. Aside from its affordable rates and 24/7 customer support, the company offers a wide variety of additional services.

Travelers - the most affordable for new homeowners

If you are new to Kentucky and need home insurance, you should look into Travelers. Travelers offers many insurance options to those who are new homeowners, such as increased property coverage or home-sharing coverage.

The Travelers Home Insurance policy offers you financial liability to protect all of your possessions from theft, damage and natural disasters. It offers many discounts and options to save you even more.

You should choose the most suitable home insurance provider for you. By using Insurify, you can compare side-by-side quotes from top insurance companies to find the right coverage at the best price for your situation.

Most policies exclude coverage for mudslides.

If you live near a land slide-prone area, you should look into your options for a home policy that offers mudslide and landslide coverage. These policies can fill the gaps left in standard insurance policies which leave you susceptible to damage from landslides.

In many states, pool owners pay higher insurance premiums. If you own a home with a pool, it will increase its size, risk, and value. You should make sure to have enough insurance to protect your home from unforeseen disasters.