Cheap Car Insurance Kansas

Kansas residents are likely looking for affordable car insurance. It's important to keep in mind that rates depend on several factors including your age, driving history, and credit score. You may also want to think about additional coverages, like collision and comprehensive coverage.

cheapest insurance in kansas

The best way to get the cheapest car insurance in Kansas is to shop around. Comparing quotes will help you find a company offering the lowest monthly rates and policies that fit your needs.

You can ask about discounts, and you can bundle policies together to save. Many companies offer discounts for a variety of things, such as paying your policy in full or being a good driver.

cheapest auto insurance ks

In Kansas, it's mandatory to have bodily injury liability coverage and property damage insurance as well uninsured driver and underinsured driver coverage. These coverages are important to protect yourself against a claim that exceeds the liability limits.

The right coverage level can prevent you from being hit with a large bill for an accident which was not your fault. NerdWallet offers a state-by-state breakdown to help you determine the coverage that's right for you.

If you're driving as a teenager, you should know that your insurance premiums will rise if you receive a traffic ticket or get into an accident where you were at fault. Fortunately, a few insurers will provide relatively inexpensive coverage for drivers who have been cited for speeding or have had an at-fault accident in the past.

Kansas car insurance costs are higher than average but you can find a policy with a low price. According to the laws of your state and your specific situation, it might be possible to save by bundling car insurance with homeowner's insurance or purchasing a policy offering higher coverage limits.

Cheap auto insurance ks for married drivers

State Farm will offer you savings of up to $90 on your annual insurance premium if married. Kansas residents choose this policy because it provides cheaper coverage than other insurers.

Cheaper rates for older drivers

You can save money on car insurance if you are over 50. Compare quotes from different insurers. GEICO has the best rates for this age group, but these are not available in all areas of the state.

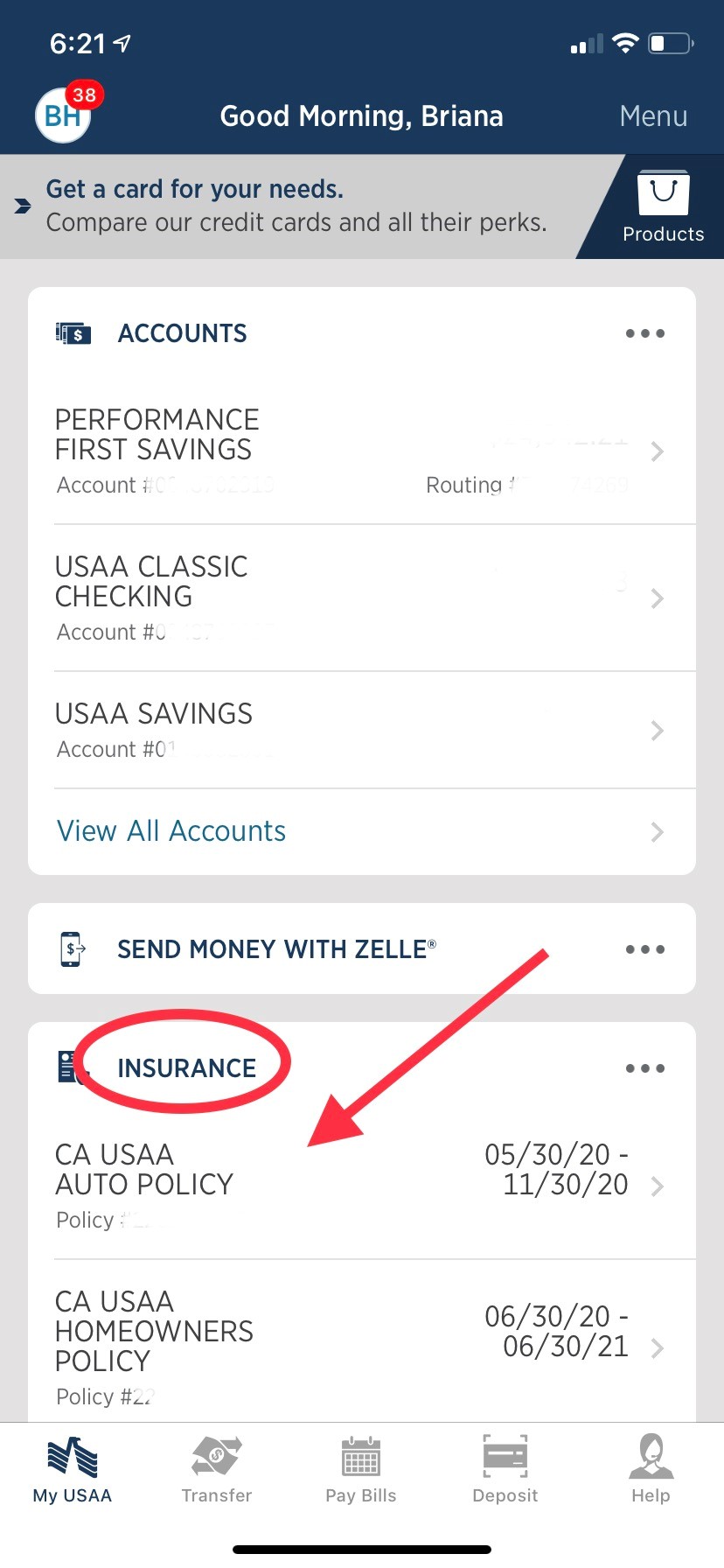

The cheapest car insurance in kansas for people with a good driving record is USAA. Most of the state is covered, though military affiliation can limit your availability.

By avoiding unnecessary coverages, and by taking the time necessary to learn about your state's requirements, you can save money on auto insurance in Kansas. This can be an easy step if you have a few minutes to devote to it.

Best car insurance in kansas for young adults

If you're a young adult in Kansas, it's crucial to choose a car insurance policy that will meet your specific needs. The average annual cost of a policy for young adults in Kansas is $460. You can expect to spend more or pay less if your policy includes different types of insurance.