In order to get the best home insurance policy in Ohio, it's important that you choose a plan with adequate coverage. It's important that you find a company offering affordable rates with excellent customer service.

The Best Homeowners Insurance Companies in Ohio

You can determine the cost by looking at several factors. This includes the location of your house, its age, condition and the amount of deductible you have chosen. Also, whether or no you opt for coverage against floods, fires or earthquakes. These factors are what can determine whether you get a low home insurance rate or one that's expensive.

Cincinnati Financial provides the cheapest Ohio home insurance, at a price that is typically less than 50% of the state average. The company offers many different policies and tiers. It is a good choice for people who are looking for a flexible policy to suit their needs.

Cincinnati Financial also has very low rates on older homes. These are especially useful for people looking to protect property at an affordable rate.

The average cost of homeowners insurance in Ohio is $44 per month, or $529 annually. This is almost 56% less than the average for the state. Its customer service is also extremely high-rated, with fewer than half of its customers reporting problems.

MoneyGeek reviews thousands of quotes provided by dozens of insurance companies to determine those that offer the most value. We then grade each provider based upon the affordability and level of service of their policies as well as the quality of their quotes.

Average home insurance costs in Columbus are $1,050 per year. It is slightly above the statewide $1,399 average, but still much less than in some other cities of the state.

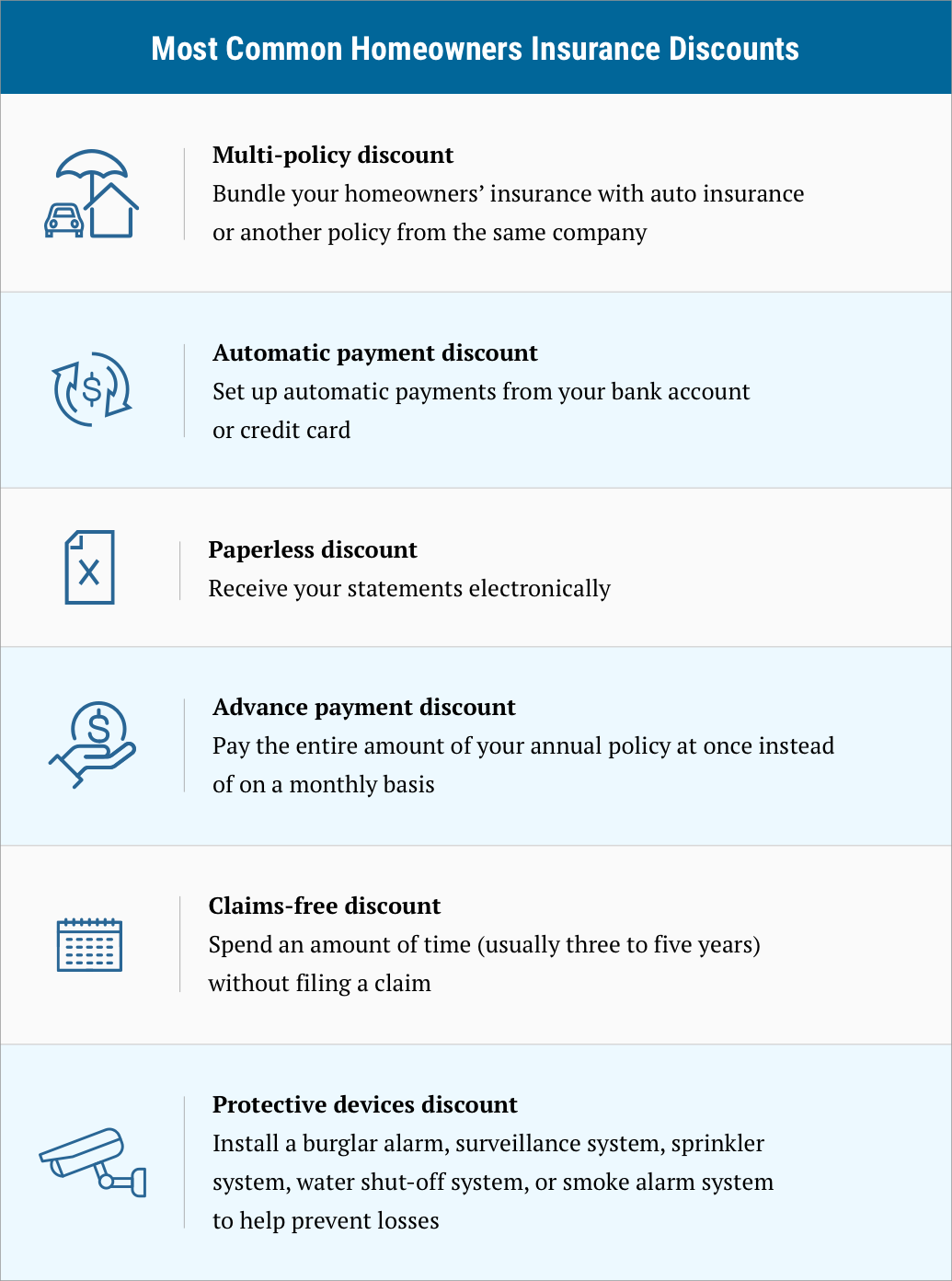

Bundling home insurance with auto coverage can reduce your rates. Many companies offer a discount of 25% or more for those who bundle their policies together.

Homeowners who replace their roofs can save a significant amount on home insurance. A new roof is worth more than an older one, which will need to be replaced in the future.

As a general rule, you should buy enough insurance to cover the cost of replacing your home. If you have additional coverage, it can be used to cover damage that is not covered under your current policy.

Another great option is to choose a deductible that's relatively low. For example, a $500 deductible is usually cheaper than a $2,000 deductible, and that's often the way to go for a low-risk homeowner.

Finding the best homeowners' insurance in Ohio can be challenging. However, with some patience and research you'll find a plan to fit your budget. Fortunately, MoneyGeek has made it easier than ever to compare rates from the top providers in the country.