There are many methods to find the best home insurance deal. Shopping around is the best way to find the best home insurance deal. While the premiums of companies that have been recommended to you will be lower, this does not mean they are less reliable. The insurance premium refers to the annual cost of your insurance if there are no claims. Another consideration is the insurance deductible. This refers to the amount you will have to pay from your own pocket before your policy covers something.

Higher deductibles

If you are a homeowner with a low or moderate income, you may be able to lower the cost of your home insurance by choosing a higher deductible. A higher deductible means that you will have to pay more out of pocket. It is worth taking the time to calculate your monthly expenses. Also, consider the amount of money you have in an emergency fund.

Apart from paying the deductible amount you must also select the type of deductible. There are two types of deductibles available: the fixed dollar amount and percentage. Fixed dollar amount deductibles give you the option of choosing the exact amount up front, while percentage deductibles are based on the value of your home. You can also choose to split your deductible. This means you can have a part of your coverage under the dollar amount deductible while others are under the percentage deductible.

Lower coverage limit

A few questions will help you determine if you can reduce your home insurance coverage. The dwelling coverage limit is determined by your insurance provider based upon the replacement cost estimate for your home. You can verify your property details by contacting reputable homebuilders in your region to determine if this limit is appropriate. Once you've determined the correct limit, you can ask your insurance agent to adjust the amount.

The dwelling coverage limit may not cover the cost of rebuilding your house back to its pre-disaster state. The cost of replacement may go up due to inflation and higher labor costs after a natural event. Your policy limits usually are only updated once every year. You can increase your coverage limit if you know you'll need to rebuild your home in the future.

Cities with high arson, burglary, and arson rates

Property crime covers a broad range of crimes including arson, burglary and vehicle theft. Although arson and burglary make up the majority of property crimes in the United States there are many other types.

Washington, DC, which had 3,493 property crimes per 100,000 residents, had the highest crime rate in 2020. Additionally, Washington, DC had the highest number of violent crimes with a rate of 1,000 per 100,000 people, more than double that in Connecticut and Massachusetts. Maine had an 8 percent violent crime rate, making it the state with the lowest violent crime rates.

Insurers offer discount

You can receive many types of discounts when you purchase home insurance. Depending on the insurer, the discounts can be quite substantial. State Farm offers a discount for customers that have not had a claim in five years. This discount may be included in your premium.

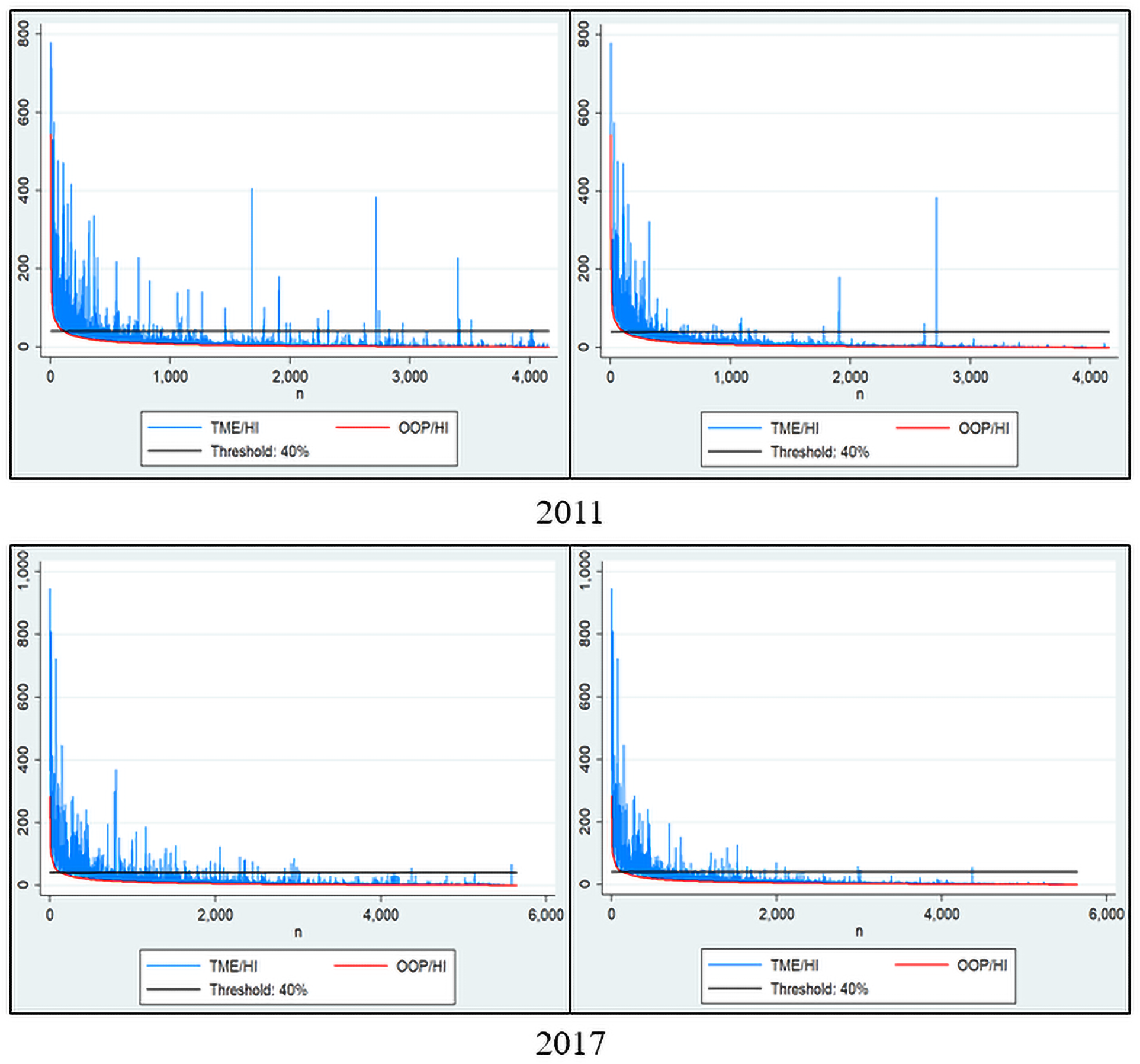

Some of the discounts that you can get when buying home insurance are cumulative, but not all of them. Insurers generally limit the savings to 40%. The maximum discount is not available to everyone. High-quality credit scores and clean records are typically eligible for the best discounts. Some insurers may also offer discounts for certain criteria, such zip code. You can also save money by only purchasing the insurance you need.

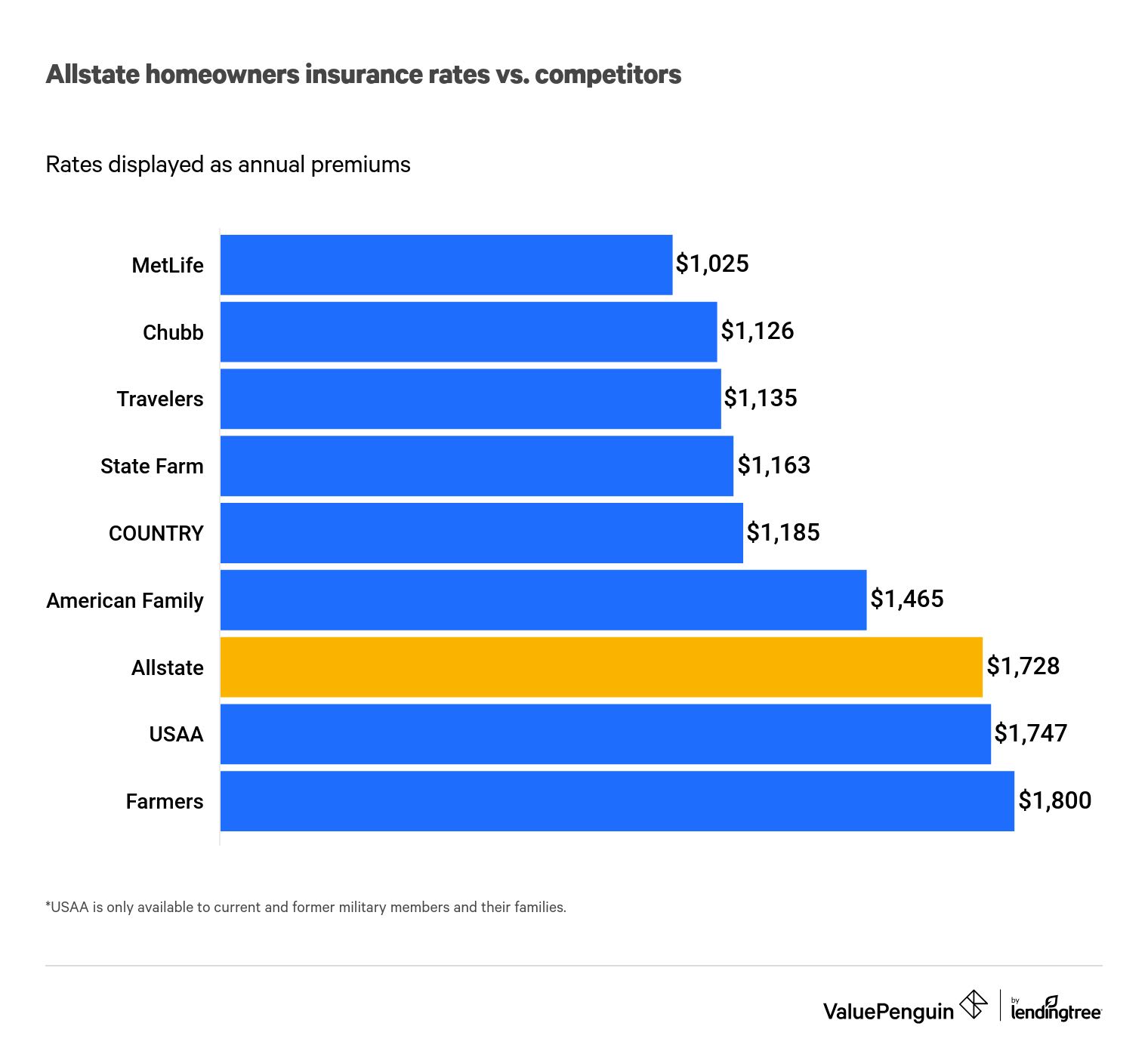

It is important to choose the most affordable provider

The best way to get home insurance at the lowest rate is to shop around for quotes. Visit comparison websites to find out more. These websites let you enter some details about your home to compare different insurers. Many sites have reviews about insurers. When comparing different insurance companies, it is essential to know the replacement cost of your home, as this will impact the rate that you'll pay. This estimate should be done every few years.

The location is important as well. Different insurers will have different premiums. One insurer may have lower premiums due to your location. If you live in an area that is prone to high crime, your rates may not be the same as those who live in smaller towns or cities.